Bondora is an online lending platform in Europe. On the one hand there are people in need of loans and on the other side there are people who lend them money. It’s basically like how a bank works, but the intermediary is an online platform, not a big bank.

I started using it in 2015 and have made a few mistakes so far. I thought I’d share those, plus how I’m doing it right now (which is much more successful).

How I started

I basically started how anyone without knowledge would start: by setting the system to auto-mode. Big mistake ;-)

So on Bondora, you have a few different options for picking the loans you’ll invest in:

Portfolio manager

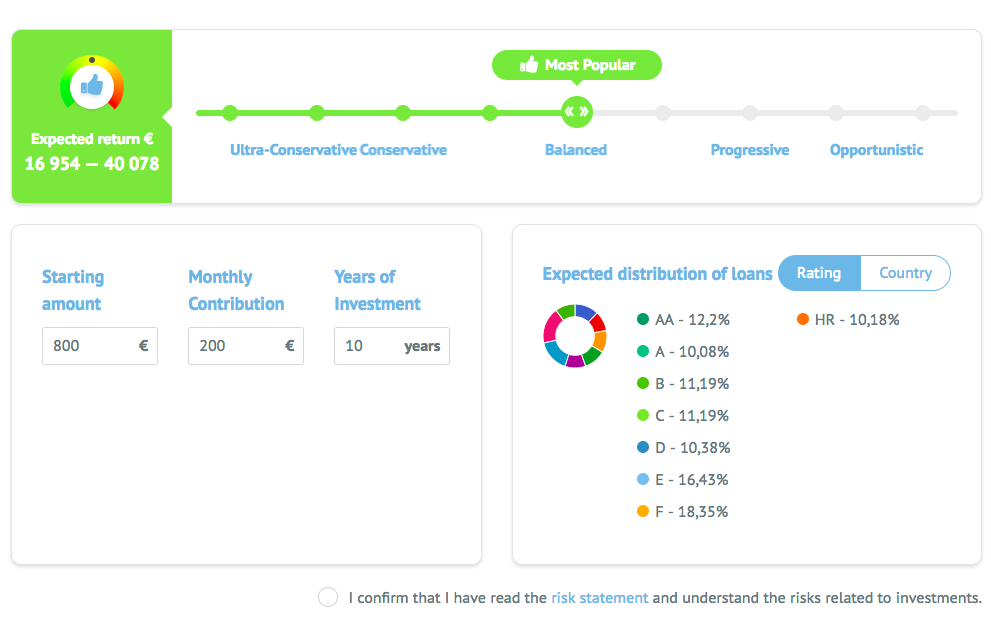

This is the basic version. You simply tell the platform what kind of risk you’re willing to take and it starts lening the money you’ve uploaded into those kinds of loans. There are no additional settings or modifications you can make.

As you can see under ‘distribution of loans’ Bondora offers a rating system for the kind of loan. It goes from AA (pretty safe) to HR (high risk) and everything in between.

Of course, the more riskier loans are also the ones that offer the highest intrest rate, so it makes sense that they would be part of a balanced portfolio.

However … when I set it like this, those higher risk loans turned out to be exactly what they promised and I lost a big chunk of my money there. Now, I’m not sure if it was me, but I wouldn’t try the automatic mode again.

Portfolio Pro

This is pretty much the same as above, but you have a lot more flexibility in deciding what kind of loans you lend to.

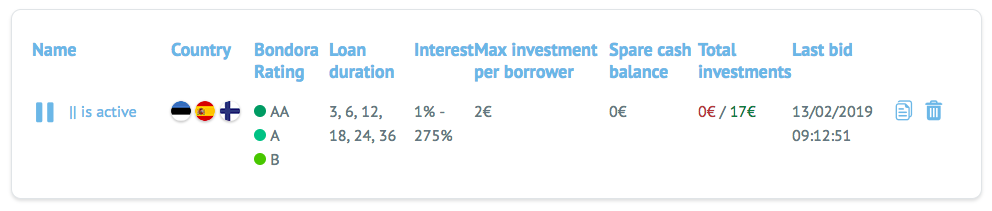

After loosing all that money I decided it would be better for me to only lend to low risk borrowers. So I set my Portfolio Pro to only lend to AA, A and B borrowers. And I only want to lend a maximum of €2 per person, so I can spread out my risk.

And now, very slowly, my return rate has steadily been going up again so I’m definitely keeping these settings.

If you want to try out Bondora yourself, you can sign up via this link to receive a €5 starting amount (and yes, I receive a little something as well).

ps: If you’re like me and not very trusting of platforms like this … I have already withdrawn some amounts back into my ban tk account, just to see if I could get the money out again ;-)

Please note: I'm not a financial advisor and don't give any recommendations here. I'm just telling you how I handled these things. Please do your own research.